Tips for protecting boats and motorcycles

A trip in an RV shouldn’t ruin your marriage…or your day

Tips to Ensure Your ATV is Properly Covered

Tips for Smooth Sailing this Season

Eight Tips for Getting Ready for RV Season

Eight Tips to Gear Up for Motorcycle Season

Motorcycle Insurance 101

Tips For Protecting Boats And Motorcycles

Before you take your motorcycle on the road or put your boat on the water, it may pay to be certain your insurance is ship-shape.

Motorcycles and boats are often significant investments, and the right insurance policy can help protect them. Here are a few tips, courtesy of PlatinumOne Insurance Agency:

- Evaluate your specific needs. Insuring a boat or a motorcycle is different than insuring your car or home. A specialized motorcycle policy, for instance, can provide coverage for custom paint jobs and aftermarket equipment that might not be covered if the bike were just added to a generic auto policy.

- Similarly, a specialized boat policy could cover things like the cost to replace lost or damaged fishing gear and costly services such as emergency on-water towing and fuel-spill cleanup. You probably wouldn’t get this coverage by adding a boat to a homeowner’s policy.

- Consult with an independent agency – like PlatinumOne Insurance Agency . Unlike “captive” agents who represent only one company, independent insurance agents and brokers are licensed insurance professionals who represent several companies. They can offer you a variety of coverages, review and evaluate your policies, suggest new coverage options that meet your changing needs and answer your questions.

“An independent insurance agent or broker can make sure you have the specialized coverage you need to protect your boat or bike,” said Jim Lloyd, of the Progressive Group of Insurance Companies. “Some insurance companies provide only bare-bones protection for your boat or motorcycle by simply adding it onto your existing auto or homeowner’s policy, but independent agents and brokers can review and evaluate your needs to help match you with the company that will provide you with the combination of specialized coverage, service and price that’s best for you.”

To learn more about Progressive Boat and Motorcycle insurance, contact PlatinumOne Insurance Agency or visit progressiveagent.com.

A trip in an RV shouldn’t ruin your marriage…or your day

Mistakes happen, especially when you’re somewhere unfamiliar, but the results of a recent survey may still surprise you.

The survey found that among RVers, a spouse is more likely to be accidentally left behind than the dog.

A leading RV insurer, The Progressive Group of Insurance Companies, surveyed more than 1,000 RVers countrywide to uncover amusing mishaps they’ve experienced while traveling.

The survey found that the most common blunders made while traveling are:

- driving away with the steps extended;

- backing into something;

- misjudging overhead or side clearance space;

- not connecting taillights correctly; and

- running out of gas.

The survey found that 53 percent of RVers spend a month or more each year traveling the open road, and 42 percent travel more than 500 miles per trip.

Traveling the open road in an RV can be a great adventure, but sometimes it gets a little bumpy. That’s why RVers were also asked about their insurance. When mishaps happen, you want to get back on the road fast—ideally with all of your passengers on board.

Only 28 percent bought a stand-alone insurance policy with specialized RV coverages. In fact, 54 percent simply added their RV to their auto policy, and 14 percent didn’t buy any RV insurance.

Although mishaps can sometimes be funny, they can also lead to costly damages. Simply adding your RV to your auto policy can leave you woefully underprotected. It’s important to know what coverages are available to adequately protect yourself and your vehicle.

“There are huge differences in coverage and services from companies that specialize in RV insurance,” says Cathy Pelfrey, RV product manager at Progressive. “Check with your local independent insurance agent or do research online so that you buy the policy and coverages that are right for you.”

To find an independent agent, visit progressiveagent.com. For more information on specialized RV coverages, visit rv.progressive.com.

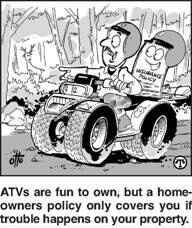

Tips To Ensure Your ATV Is Properly Covered

(NAPS)—When it comes to your all-terrain vehicle (ATV), it pays to keep your feet on the ground when it comes to insuring it. You may think it’s covered by your home-owners policy, but are you really protected? Your “toy” wasn’t cheap, and lacking the right type of insurance coverage could lead to a sticky financial situation.

(NAPS)—When it comes to your all-terrain vehicle (ATV), it pays to keep your feet on the ground when it comes to insuring it. You may think it’s covered by your home-owners policy, but are you really protected? Your “toy” wasn’t cheap, and lacking the right type of insurance coverage could lead to a sticky financial situation.

“Owners should think of ATVs the same way they think of motor-cycles,” said Rick Stern, product manager, The Progressive Group of Insurance Companies. “You’d never consider getting on a motor-cycle without the proper insurance, and you shouldn’t ride an ATV without the right coverage either.”

If you’re not sure what to do about your ATV insurance needs, here are a few things to consider:

Your homeowners policy might not be enough. Most likely, your homeowners policy only covers your ATV if trouble occurs on your property. Anywhere else and you’ll be exposed. Look for an affordable ATV insurance policy that offers coverage no mat-ter where you are. Trail riders should be aware that many states require ATV insurance for vehicles operated on state-owned land.

What about theft? ATVs are portable and can be easy targets for thieves. You should consider ATV insurance that provides coverage for things such as theft, fire and vandalism—just like the kind you can get for a motorcycle. Theft, fire and vandalism are covered by Comprehensive coverage, an optional physical damage coverage.

Consider uninsured and underinsured coverage. You never know what can happen in the great outdoors. This relatively inexpensive coverage protects you if another rider causes damage to you and he or she lacks adequate coverage.

Keep your rates low. You can do a number of things to save money on your ATV insurance, including maintaining a clean driving record, staying free of claims or choosing a less “sporty” ATV. In addition, most insurers offer a discount if you insure more than one vehicle on your policy, or have more than one policy with the company. This could mean additional savings on your car, motorcycle, boat or RV insurance.

For more information about ATV insurance or to find an independent agent, visit the Web site at progressiveagent.com.

Did You Know?

ATVs are fun to own, but most likely, your homeowners policy only covers your ATV if trouble occurs on your property. Anywhere else and you’ll be exposed. Look for a policy that offers coverage no matter where you are. For more information about ATV insurance or to find an independent agent, visit progressiveagent.com.

Tips For Smooth Sailing This Season

(NAPS)—Before you take that first pleasure cruise or fishing trip of the season, make sure your boat insurance is shipshape.

Insuring a boat is different than insuring a car or home. Boats require specialized coverages. To avoid a sinking feeling about your boat insurance, consider these tips from the experts at The Progressive Group of Insurance Companies:

Evaluate your specific needs. Some insurance companies provide no-frills boat coverage that is simply added to an existing auto or homeowners policy. While this sounds good in theory, the reality is that your boat may be best covered if you seek out a specialized policy just for boats, not an add-on to your car or house policy. A knowledgeable, independent insurance agent will review all options with you. A specialized boat policy can cover things not likely covered by a homeowners policy, like the cost to replace lost or damaged fishing gear and costly services, such as emergency on-water towing and fuel-spill cleanup.

Consult an agent or broker who provides the most options. Unlike “captive” agents who represent only one company, independent agents and brokers represent several. They can offer a variety of coverages, review and evaluate your policies, answer your questions and suggest new coverage options that meet your changing needs. They guide you to the policy that provides you with the best combination of specialized coverage, service and price.

Look for a company that offers specialized boat policies. When there’s a claim, you will appreciate a company that provides specialized coverage and specialized claims handling. Ask other boaters what company they recommend or find an independent insurance agent who understands boat policies.

Once you choose a policy, make sure you understand what you’re buying. Your agent should be able to explain, in layman’s terms, what the different options mean. If you are unclear about something, be sure to ask for an explanation.

For more information about boat insurance coverages, talk to an independent insurance agent, who can provide you with the combination of price, coverage and service that’s right for you. To find an independent agent, visit progressiveagent.com.

Did You Know?

For information about boat insurance coverages, talk to an independent insurance agent, who can provide you with the combination of price, coverage and service that’s right for you. To find an independent agent, visit progressiveagent.com.

Eight Tips For Getting Ready For RV Season

(NAPS)—If you enjoy roaming the road with your recreational vehicle (RV), you have lots of company. Millions enjoy that freedom, too. Here are some general tips that will help to steer you towards a stress-free season on the road:

Clean it up and air it out. Open all roof vents and windows and then remove any pest control items you may have placed during winter storage. It is also a good idea to clean or replace air conditioner filters.

Check for damage.

- Look for deterioration of seals around doors, roof vents and windows and reseal as necessary.

- Check awnings for damage, mildew and insects.

- Examine the hitch system for wear, loose bolts and cracks.

Change the engine oil and spark plugs. Many manufacturers recommend changing the oil and filter prior to storage and again in the spring. During storage, oil can separate and cause condensation buildup that may harm the engine. While replacing spark plugs, be sure to set the gaps to the recommended manufacturer’s setting.

Inspect the engine.

- Check the battery.

- Check the cooling and fuel systems.

- Drain and flush the entire system of the nontoxic antifreeze you used before placing the RV into storage and replace with the proper coolant.

- Check for cracks in hoses and fan belts and replace if necessary.

- Replace fuel filter, and examine the fuel lines and fittings for cracks and leaks.

- Change the transmission fluid and filter.

- Flush the water system.

Inspect the tires. Check for cracks, worn treads and correct tire pressure.

Check all lights. Make sure headlights, taillights, brake lights and turn signals are all functioning properly.

Prepare for a safe season. After checking all mechanical components, it’s always a good idea to inspect your safety equipment. This means installing new batteries in flashlights and smoke and carbon monoxide detectors and restocking the first-aid kit.

Check your coverage. After making these routine checks, don’t forget to review your insurance policy to make sure it meets your current needs. Progressive, for example, has been insuring RVers for more than 25 years and understands their needs and wants, so it has developed specialized coverages that offer true protection.

It covers more than other companies that simply add RVs onto an existing auto policy.

For more information about specialized RV insurance coverages, visit progressiveagent.com.

Did You Know?

After RVers make routine checks, they should review their insurance policy to make sure it meets current needs. Progressive, for example, has developed specialized coverages that offer true protection, much more than other companies that simply add RVs onto an existing auto policy.

Eight Tips To Gear Up To Motorcycle Season

(NAPS)—To steer this riding season in the right direction, you’ll want to make sure your motorcycle—and your motorcycle insurance policy—are in good working order before hitting the open road.

While you should always check your owner’s manual for specific guidelines, here are some general tips for getting ready:

- Change the oil and filter. Many manufacturers recommend changing the oil and filter before storing a bike for any extended period of time and again when you bring it back out for riding season. Be sure to first start up the motorcycle to warm the engine and then shut it off before changing the oil and filter.

- Check the belt or chain. Make sure it is set to the manufacturer’s recommended tension. And if you have a chain, lubricate it.

- Check nuts and bolts. Start off the riding season with a solid bike. Make sure everything is tight. “A well-maintained motorcycle not only assures a fun time, it can save you money by avoiding accidents, which helps to keep your insurance rates down,” says Rick Stern, motorcycle product manager, The Progressive Group of Insurance Companies.

- Inspect tires. Look for any damage and also make sure each tire is inflated to the correct pressure. You’ve only got two tires, so for maximum stability it is very important to avoid underinflation as well as overinflation.

- Look for fluid leaks. The easiest way to check for this is to look at the floor under the motorcycle. Leaking oil or brake, radiator or clutch fluid can cause their own special problems. For example, being low on brake fluid could make it hard to stop your motor-cycle. You don’t want to find that out after you’re already on the road.

- Check all lights. Make sure headlights, taillights, brake lights and turn signals are all functioning properly.

- Brush up on your riding skills. Find a safe place to practice riding skills such as fast stops, figure eights, U-turns, etc., so you’re ready for the season. You’ll be glad you did.

- Update your policy. Perhaps one of the most important things you can do at the start of the season is review your insurance coverage to be certain you, and your bike, are covered. Talk to your local independent insurance agent.

Independent agents represent many companies and they can help you to understand the cover-ages you need. An independent agent can also help you find the combination of price and service that’s right for you. To find an independent agent, visit the Web site at progressiveagent.com.

Did You Know?

To steer this riding season in the right direction, you’ll want to make sure your motorcycle— and your motorcycle insurance policy—are in good working order before hitting the open road. To find an independent agent, visit progressiveagent.com.

Motorcycle Insurance 101:The Essentials

(NAPS)—A motorcycle is a significant investment. Before you get your motor running and head out on the highway this season, you owe it to yourself to make sure your insurance is up-to-date and you’re properly covered.

(NAPS)—A motorcycle is a significant investment. Before you get your motor running and head out on the highway this season, you owe it to yourself to make sure your insurance is up-to-date and you’re properly covered.

“Just as riding a motorcycle is much different than driving a car, riders should know that their motorcycle insurance needs are different, too,” said Rick Stern, motorcycle product manager, The Progressive Group of Insurance Companies.

Here are some tips:

Update your policy. First, verify that all your coverages are still in force. Be aware that some companies have a winter layaway period during which some cover-ages are restricted. Check with your insurance company to see if you currently have any type of limited coverage. Next, note any changes such as additional riders or a new garaging address. A quick call to your independent agent or insurance company will ensure coverage that reflects your current needs.

Consider additional liability coverage. If you have significant assets, it may be to your benefit to carry a higher limit just in case you are involved in an accident that causes injury to some-one else or damage to property.

Look into medical payments coverage. Medical payments coverage pays your medical bills as well as your passenger’s and is available in limits up to $25,000 in most states.

Make sure custom parts and equipment are covered. Additional parts such as chrome plating, a custom paint job, saddlebags or special rims usually increase the value of your motorcycle and may not be covered. If you’ve added any custom parts or equipment, you’ll want to check your policy or call your independent agent to make sure they’re covered.

Know your options. Rates can vary, so shop around to see if another company offers you a better rate or if you qualify for any discounts. If you have comprehensive and collision coverage, consider raising your deductibles. Doing so can help to lower the cost of your policy.

Choose a company that specializes in motorcycle insurance. For example, Progressive is America’s largest motorcycle insurer. Progressive agents and brokers understand the special needs of motorcycle owners and offer specialized coverages that are designed for them and their bikes.

For more information about motorcycle insurance or to find an agent, visit progressiveagent.com.

Did You Know?

Riding a motorcycle is different from driving a car. Motorcycle insurance needs are different, too. That’s why it’s important to choose a company that specializes in motorcycle insurance. For example, Progressive is America’s largest motorcycle insurer. For more information, visit progressiveagent.com.